Etching and cleaning are essential? Focus on an important branch of electronic gases - fluorine-containing special gases!

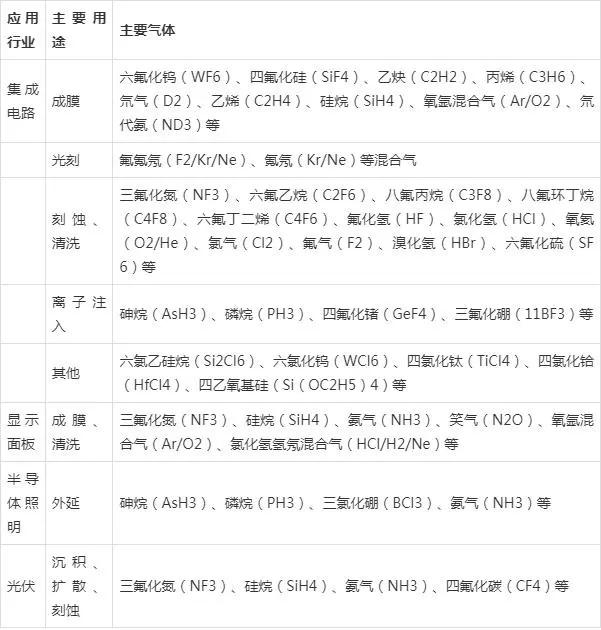

Electronic gas includes bulk electronic gas and electronic special gas. It is an indispensable key material in the manufacturing process of integrated circuits, display panels, semiconductor lighting, photovoltaics and other industries. It is the second largest manufacturing material for integrated circuit manufacturing, second only to silicon wafers, accounting for 13% of wafer manufacturing costs. Electronic special gases are mainly used in photolithography, etching, film formation, cleaning, doping, deposition and other process links. They are mainly divided into cleaning gases such as nitrogen trifluoride and metal vapor deposition gases such as tungsten hexafluoride.

Data source: China Electronic Specialty Gas Market Competition Status Analysis and Investment Strategy Research Report (2023-2030)

2. Global Electronic Specialty Gas Market Capacity Analysis

According to the "China Electronic Specialty Gas Market" released by Guanyan Report Network Market Competition Status Analysis and Investment Strategy Research Report (2023-2030)" shows that in recent years, with the growth of demand in downstream markets such as integrated circuits and display panels, electronic specialty gases, as one of the important raw materials in the production process, have also shown a steady growth trend in market size. According to the data, the market size of the global electronic specialty gas industry has increased from US$3.691 billion in 2017 to US$4.538 billion in 2021, with a compound growth rate of 5.30% from 2017 to 2021. It is expected that the market size will exceed US$6 billion in 2025, and the compound growth rate from 2021 to 2025 is expected to reach 7.33%.

Data source: China Electronics Specialty Gas Market Competition Status Analysis and Investment Strategy Research Report (2023-2030)

2. Global Electronic Specialty Gas Market Capacity Analysis

Specific analysis from the downstream application market, currently my country’s Electronic Specialty Gas Market The industry is mainly used in integrated circuits, and its market share accounts for 42% of the total industry demand, followed by the display panel industry, with a market share of 37%.

(1) Integrated circuits

In recent years, driven by downstream market demand, and under the coordination of relevant parties such as national and local special investment funds, my country's integrated circuit industry has ushered in new development opportunities. According to IC Insights data, my country's integrated circuit market demand in 2020 is US$143 billion, and it is expected to reach US$223 billion in 2025, with a compound growth rate of 9.29%. The output value of integrated circuit manufacturing is US$22.7 billion, with a self-sufficiency rate of 15.87%.

(2) Display panels

In recent years, driven by multiple favorable factors such as national industrial policy support and technological breakthroughs, my country’s display panel industry has developed rapidly, and has formed an industrial cluster led by key enterprises such as BOE, TCL Technology, Shenzhen Tianma, and Visionox. The global production capacity accounts for more than 60%, which further drives the steady development of the electronic specialty gas market. According to data, the market size of the display panel industry in mainland China will reach 91.1 million square meters in 2020, and it is expected to reach 116.5 million square meters in 2024, with a compound growth rate of 6.34% from 2020 to 2024.

At present, the CR10 of the global electronic gas industry is as high as more than 90%. Among them, Linde, Air Liquide, Taiyo Nippon Sanso and Air Chemicals occupy a leading position in production by virtue of their strong technical service capabilities and brand influence, with a market share of more than 70%.

Specifically in the field of electronic specialty gases, the world’s major manufacturers are SK Materials, Kanto Denka, Showa Denko, and Perete Gas. Although these companies have a gap with the four international giants of electronic gases in terms of overall scale, they have strong competitiveness in subdivided fields.